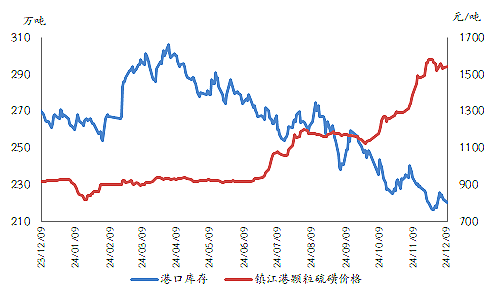

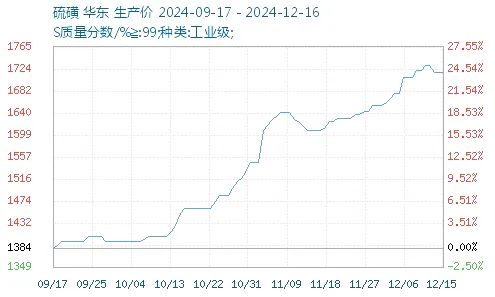

In 2024, China's sulfur market had a sluggish start and had been silent for half a year. In the second half of the year, it finally took advantage of the growth in demand to break the constraints of high inventory, and then prices soared! Recently, sulfur prices have continued to rise, both imported and domestically produced, with significant increases.

The large change in price is mainly due to the gap between the growth rates of supply and demand. According to statistics, China's sulfur consumption will exceed 21 million tons in 2024, an increase of about 2 million tons year-on-year. The consumption of sulfur in industries including phosphate fertilizer, chemical industry, and new energy has increased. Due to the limited self-sufficiency of domestic sulfur, China has to continue to import a large amount of sulfur as a supplement. Driven by the dual factors of high import costs and increased demand, the price of sulfur has risen sharply!

This surge in sulfur prices has undoubtedly brought tremendous pressure to downstream monoammonium phosphate. Although the quotations of some monoammonium phosphate have been raised, the purchasing demand of downstream compound fertilizer companies seems relatively cold, and they only purchase on demand. Therefore, the price increase of monoammonium phosphate is not smooth, and the follow-up of new orders is also average.

Specifically, the downstream products of sulfur are mainly sulfuric acid, phosphate fertilizer, titanium dioxide, dyes, etc. The rise in sulfur prices will increase the production costs of downstream products. In an environment of generally weak demand, companies will face huge cost pressure. The increase in downstream monoammonium phosphate and diammonium phosphate is limited. Some monoammonium phosphate factories have even stopped reporting and signing new orders for phosphate fertilizers. It is understood that some manufacturers have taken measures such as reducing operating load and carrying out maintenance.

Post time: Dec-17-2024